Disclaimer: (haha)

I hope none of this comes across as being a total egotistical "showoff", bragging about everything, just wanted to explain things a bit and show a bit more detail on some things. Hopefully it can be somewhat useful/beneficial to you in some way.

Brief Explanation/Intro:

I feel like my most useful "trader attribute's" are being able to "trade size" comfortably and also be able to "bounce back quickly" from setbacks/big losses. I feel that's how I've been able to do what I just did this month. I feel like I have a pretty good "disconnect" from the money I guess, I am able to just trade the chart and not get very emotional (this can be great for winning trades but terrible for stubborn losing trades, I rarely "panic out" out on losses). Something that helps me personally, is having my realized and unrealized PnL off of my position box, and I hiding it at the top (and occasionally look at the realized part, usually once I'm finished with the trade), I've been doing this for 6+ months and it helps "disconnect" from the money. That's just what works for me, everyone else is different. Over the last three weeks, I "exponentially" increased my position sizes, but focusing on these "niche" (2-6 dollar big gap up/big range/big volume stocks) and focusing 100% on the chart, level 2, and time and sales.

These numbers are just insane, I do post "win or lose", "the good, the bad, and the ugly", but even still, I feel like posting PnL on twitter is a "double-edged sword". I enjoy doing it, and it can be "motivating for others" (positive thing), but it's can also be very discouraging for others that are struggling and/or not wanting to trade so big and/or getting unrealistic expectations from what I've been posting lately (negative things). I want to continue posting, but I don't want to come across as bragging/super egotistical and I also don't want to discourage others and/or put unrealistic expectations in front of them that may lead to them not succeeding at trading because of being discouraged or from trading too big of size that the aren't comfortable with and taking a big loss that takes them "out of the game". I plan to keep posting but please email JGram135@hotmail.com if you have any input, and want to say whether I should keep posting or not, I would like to hear some input from others, also you can reach me there if you have any questions and I can try to help if I can.

Day by day (before commissions):

A few of them may be slightly different than what I posted on twitter, if I posted early and had a few random trades and I didn't post again, also these are the numbers taken off of the platform, the numbers usually end up different on iBoss with an overnight position (I had two overnight positions), but I also posted the totals by ticker after this.

Ticker by ticker (True PnL = After comissions/ecn rebates or fees):

Only 38 total tickers for the month, which is considerably less than June and July were for me personally. Not that the total number for the month means a whole lot, but basically I was just 100% focused on 1-3 stocks each day that were the BEST setups, and sizing into them with "houses money", etc. Not trying to "scalp" a little bit of everything, and trading 5-10 tickers a day (this does work for a lot of successful traders but just not for me). This seems to be what works best for me and I will try to continue to focus on 1-3 MAIN "plays" each day as I have been doing. Most of my gains, (90%+) were on my "niche" 2-6 dollar big gap up/big range stocks, mostly on the short side. I focused on 1-3 BEST plays per day for the most part, and exponentially increased my size as my confidence and conviction in trades grew, and it added up fast.

I explained quite a bit of detail leading up to August 12th, I just wanted to explain like how "low" I was at times, in terms of account size and in confidence with back-to-back big losing days, but I was able to pick myself back up and bounced back intra-day both times, without being able to do that, none of this may have ever happened.

I started off the month not very confident, June and July I was up a lot mid-month and I ended up giving it a lot of it back in a few trades/days. I decided to write a blog post about consistency http://jgramtrades.blogspot.ca/2015/08/focusing-on-consistency-and-your-niche.html on August 3rd and I was planning on posting on the blog again daily for August and I was trading pretty small and really trying to plan out my trades and have a set risk/idea for each trade. Slow and steady, I had relatively small gains for four days, adding up to a decent week (at the time).

Then came AQXP, I started shorting below 3 with not much reason to, long story short, I ended up down 13k realized as it ran from 2.50's to 6.20's (from 1.79 previous day close), breaking most/all of my rules that I just talked about on my blog about consistency, mostly the part about being stubborn past 10:30 AM ABOVE VWAP on DAY ONE (this is where 90% of my big losses come from). I'm not trying to make excuses, but I feel part of the reason I was so stubborn, was because there ended up being no more shares to short after the first hour or so (which is something that never happens with Suretrader, usually if you have them, then you have them all day, they can't "run out"), I didn't want to take the loss where it was currently trading at because I knew I wouldn't be able to get back in, I decided to just try to "wait it out" on the rest that I had left, that sure was a bad idea.

Those rules are what I wrote at the time, but I'm not really using most of them now (2k max losing day doesn't really work with the size I'm trading now). These are the ones I'm trying to still pay attention to:

- Trying to avoid INTRA-DAY "news plays" as much as possible (LOCK, FELE, etc.), SET RISK and SMALLER SIZE ONLY if I'm going to trade it at all (no trying to catch the bottom/short the top/top of the bounce)

- NEVER BEING STUBBORN PAST 10:30-11 AM, if the stock has RECLAIMED VWAP at this time, there is a good chance it will continue much higher throughout the day (be long biased and never be "stuck short"), once it breaks HOD, it's usually "off to the races", like ITEK "day one" and VLTC "day two". A convincing VWAP reclaim is WHERE TO BE stopping out on a short (this would have saved me on PTBI, SGYP, ITEK, and others) (use hard stops if needed, to stop out on these "crossovers")

- Being extremely careful on the short side on "Day One", where the stock is trading at 10:30-11 AM is a usually a good indication of which direction it will continue the rest of the day (TLOG and MNOV, well below VWAP, near LOD's, they faded the rest of the day) (PTBI, SGYP, ITEK, had reclaimed VWAP and were trading in the top 25-50% of the trading range, they continued much higher throughout the day)

I took a break for 30 minutes-hour, and came back wondering what I should do. Should I keep trading and try to make it back? Should I stop for the day and/or take some days off to try to forget about it? I felt terrible, this was a pretty big loss (my second biggest losing day ever). I decided to keep trading but I was trying to not be super emotional, I hid my realized and unrealized PnL again and tried to just trade the chart. There were no more shares to short on AQXP after the first hour AQXP was still consolidating around 5.50-6.20 and was making a giant "bull flag" and still holding well above VWAP. I ended up longing 2-3k shares from 5.80-6.10, and selling 6.50-6.70 or so, I think I made 1000-1500. That was the new high of day breakout so I should have held longer, but the stock was still up 300% or something crazy and I wasn't sure I guess. I traded it really weird, but I just didn't fully trust it, it was like, "I know it's going at least 20 cents higher if I buy the ask here, but I don't know how far it can still go considering how much it's up", basically "chasing" 2-3k shares along the way up in each dip but somewhat a "chase" (taking the ask), and selling for 20-60 cents usually, pretty much just buying the ask and going on the sell side on some of it almost immediately into the spiking. It went all the way from 6's to 11's (up 500%+), I could have made a lot more if I had just held some of these a lot longer, almost all my buys were higher than where I just sold the last time. Then I longed some other dips and washouts, 2-4k shares the rest of the day, in the 9ish-11ish "channel range". I checked on my realized PnL again occasionally but I was trying to not be too emotional. I ended up making back about 10k and finishing down around 3k, which was bearable and my week was still green.

Then came Monday, AQXP was hitting 18ish premarket and I scaled in long about 2k shares on the dip with a 16.47 avg and sold into the immediate bounce for about 70-75 cents, up $1500 before I'm normally even awake. I didn't trade it the rest of premarket, but there was definitely more to be made with the 17's-19's range. It opened at 17.50's and I wanted a washout at the open to go long, it didn't really washout, and just starting spiking, 18.50, 19.50, 20, 21 (through premarket highs of 19.50ish). I missed "chasing it" early and it would jump up a dollar in a second and I didn't want to pay a dollar more, I wanted to maybe wait for a dip to go long. There were zero pullbacks until one candle that went from 25.80 to 23.50, which still felt like it was up so much from where it was, and there wasn't really much of a chance to get in. Twenty minutes later, and 3+ volatility halts later, it was trading at 55's, even selling at 25 from 16.47 would have been incredible, definitely the most insane thing I've ever witnessed. Just missing a huge profit would have been fine if I didn't take a big loss on VLTC. I ended up shorting VLTC starting from 10.40 and adding to 11.40 or something stupid. There was just way too much "sympathy buying" with AQXP spiking so much. I had around 5000 shares 10.70's average and it volatility halted at 11.47, it re-opened at 10.70ish, and I could have taken the ask 11-11.20 if I was quick enough/aggressive enough, it ripped up to 12's and was soon 13's, I got bought in on the first washout, 12.20's for about a 9k loss = -7.5k day. Major hit to the account and confidence again, I took a break, and came back and "grinded" my way back to a -2.5k day. I couldn't help but think, "Why can't I use do this without being an idiot first?" I made about 10k back on Friday and 5k back on Monday, if only I could do that without taking that huge loss first.

I was around -1k to break-even on the month on August 10th after 6 trading days, I wanted to take a break from posting on twitter and just try to be happy with 500/day or 1000/day or whatever and stop expecting so much and not being happy with slow and steady gains. I didn't post on August 11th, but I ended up 1750, and I thought, "okay, now I'm back in the green for the month, I can just start fresh from now", and that's pretty much what I did I guess.

"It" (my craziness this last three weeks) all started with a "new best day" on August 12, +14.8k from CERE and SUNE. That was a huge account size boost and confidence boost, I did wire out 10k right away though. The next day came EBIO, which to me, was almost exactly the same pattern as CERE with the big gap up and fade (few minutes parabolic, washout, whole number/VWAP retest and "stuff" around 9:45ish and fade most/all day), and I sized in again with "houses money" and pulled off another five figure day. Then lastly on the Friday, another really big gap up on ONTX, 2-6 dollar priced stock (my "niche" setup), and a new best day again, +16.7k, so insane, 3 crazy days which exponentially increased my confidence and account size.

These are the charts for CERE, EBIO and ONTX (I didn't have the entries/exits on CERE):

I did wire out some more again, but my thinking was that I could only do 8-10k every 24-48 hours because of the "10k cash rules", so I was wiring out like every other day, but I couldn't really "keep up" to get my account much smaller (sort of a good problem to have I guess). I had quite a bit more BP but I told Suretrader to put me on 2:1 margin instead of 4:1 (which is what my account's default settings are since April by my choice, instead of 6;1) to at least keep me somewhat safer from not sizing in too big.

Monday, there weren't any great setups off the open, but I sorta used bigger size than I usually do (with no "houses money") on OHRP to for a 5k day. Tuesday, August 18th, was my 21st birthday and also my one year "anniversary" of full-time trading. The main stock "in play" was OMER, gapping up from 14.55 to 23-25 on "positive phase 2 results". This was a nice 50%+ gap up, but I knew it wasn't really my "niche", it wasn't in my 2-6 dollar priced "comfort zone", my idea off the open was scaling into a washout long or scaling into a parabolic short, 500 shares at a time, I scaled in 2500 shares 26.32 avg and it washed out to 22's-23's and I was up 7k REALIZED in 10 minutes, but I got overconfident and greedy from the last four days of "killing it" and making 7k in 10 mins and wanted more I guess, and "stuck around" with new trades on it and gave it all back and more. This is the chart with explanation, I never posted this before on twitter but here it is (very ugly, but I need to be able to share the good and the bad and learn from them both):

I just did the exact same thing on TRVN today. Shorted parabolic, made money, "stuck around" with reshorts and was up but didn't cover it all, added more again and got destroyed. Need to really watch for that and not trade so big on these "non-niche" priced stocks and/or setups.

The next day there was another 2-6 dollar 50-100% "gapper" (CRBP), my "niche" setup/play. It gapped up from 1.86, but had already faded from as high as 3.36 to 2.81 open and washed out to 2.50's/2.60's, my thinking behind the long on this trade was that one of these "gappers" "should" run eventually (most had just been fading all day and shorts have been "banking", the one that runs should go a lot further from all the overconfident shorts). Also, it had already faded quite a bit, and there was more upside than downside currently at 2.50 from 1.86 gap up, the confirmation was that 2.60 (VWAP) reclaim and act as support (could have just waited for that instead of longing a bit early like I did), looking for an opening range breakout, first key area was HOD (during market hours) break (2.84), and the next key area was premarket high's break at 3.35ish. I played this chart perfectly with house's money and then flipping short my sells at the top, it was pretty crazy, I still can't believe how well that worked out. I covered my short way too early compared to what it could have been if I held until the close but I made 16k on the way up and 16k on the way down within 2 hours, absolutely insane. I didn't have to "worry" about that "big swing" I had on OMER the day before anymore. Another huge account size boost and confidence boost.

CRBP chart:

There was also another, "big range, big volume" 2-6 dollar stock in play, CLTX and I decided to trade that as well, here is the chart for that (I never posted this on twitter before):

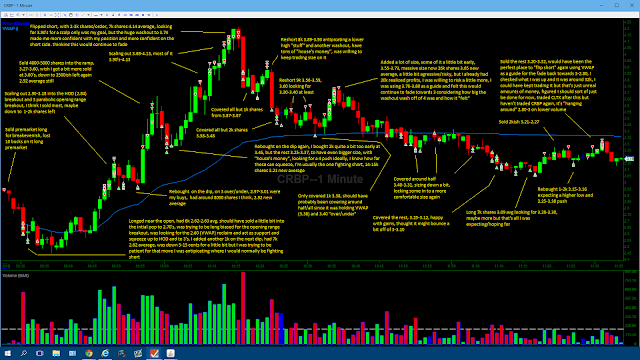

There's no text on it but I'll briefly explain it. First trade was my 7700 share short 2.37 initially with some tiny 1-2k readds, made almost 3k. Next trade(s) were up to 20-25k shares short at the very, very most after already realizing some profits on the washout. Avg was 3.10-3.20 on the last part, and I made over 10k total, covering most of it too early into the first washout. Then, I did a couple long "scalps" for like 1k total. It started ramping into the close. I tried to long the first dip and I only got 700 shares filled, I sold for a quick 10-15 cents because I didn't get my full fill. I then tried to "chase" (buy ask), I think 4k at 3.15 and I got 200 shares and sold 3.40's. I felt I had already "missed" the long and didn't want to chase it up so high when I tried to get long around 3 already. I started scaling into a short, with way too much size, somewhere around 20k shares again, just being careless, "add, add, adding" into SSR spiking, looking for covers on the first wash. It washed to 3.35 and my avg was 3.58 and I only got maybe half of it covered and missed the rest. There wasn't much time left but I was not aggressive enough to just exit the rest. I added some more again into the next "leg up", but there really was only 10 minutes left so I was being stupid, there wasn't any time for it to pullback. It had one washout to 3.66 and I got some filled at 3.68 for actually a small profit from 3.70's new average but that's all I got filled and it came back near 4 close. I thought there was a lot of selling/shorting around 4 and maybe it would fade back to 3.60-3.80 afterhours and/or gap down, maybe cover some afterhours and hold some overnight if it was gapping down. But ideally I would have just been out before the close, I was just being super overconfident/greedy and making a huge mental error. Suretrader's routes were not working afterhours and I was still in over 20k shares 3.79 average and it started spiking afterhours to 4.50+, I couldn't get out even if I wanted to. That was a super stressful afterhours session, watching every tick from my phone, hovering around losing like half of my 50k day or so at times.

With about three hours of sleep, I was up early watching every tick again premarket, it was trading between 4.30-5.50 but on very little volume before 7:00 (before I can even trade, after 7:00 is when we can trade premarket at Suretrader). I could have taken the loss at 4.50-5 (after 7:00) but I was stubborn and I figured if I took a huge loss my BP might be completely messed up and might not be able to do new trades. It continued higher up to 5.80's and I was down almost my whole day from before, just unreal how I could be so greedy and keep trading the day before. I felt terrible, I didn't want everything I did yesterday to be for nothing. It started fading towards 5, then 4.50, then nearly 4 (in 10-30 minutes during premarket still), I wasn't down too much now and I was a lot more confident in my position, as it was nearing red and it ran 300%+ the day before and VWAP for premarket was 4.90 (Suretrader doesn't include premarket trading on VWAP but I knew where it was from a friend). So basically, all/most longs from premarket are "underwater" quite a bit and if it doesn't spike at the open, everyone will be a seller and shorts will hammer it as well into the washout and on "G/R". Unfortunately by BP was still somewhat messed up at the open and I couldn't really add any, but as I watched the first 10 seconds off the open I "felt" it would wash and continue to fade. I didn't totally explain the sizes but I'd say I made maybe around 10-20k from the overnight part and 30-40k on the adds and that other trade from 3.17-3.18 and another trade later on that's not on the chart near the end of the day. I had absolutely massive size into that 9:55-10:10 bounce, after covering some and locking in something like 10k realized, I had around 50k shares 3.55 new average and covered around 2.85 average probably, that was the "bulk" of the trade, pretty crazy to have that much conviction and use that much size I guess.

CLTX chart (day two):

That is the whole explanation of those two crazy days, could have been net 0 over the two days but ended up net +100k, so thankful, but I have to make sure to stay more safe and not have that overnight risk especially on "day one". I'm likely done with overnight positions, unless it's a PLANNED swing short with a "WINNER" ONLY.

My account was really big now and I decided to put my account on 1:1 margin by my choice and 20k shares max size to make sure that I "stay safe" until I wire out more again to a much smaller account again.

Finished off the week with another five figure day from covering my CLTX overnight short position that I had left and from shorting the parabolic on MCUR for a 110k week even with the OMER loss in there, so crazy.

Then another two good days, Monday and Tuesday, here is another chart that I posted on ESI on Aug 25:

Wednesday, there were no "niche setups" and I forced a trade on VXX, was down 5-10k unrealized on a stubborn short and I decided to try to use more BP to "work my way out", I asked to go back to 4:1 margin and I managed to work my -5-10k trade into a +5k trade, pretty risky, if it didn't work out I could have ended up turning my -5-10k into -15-25k. I didn't have the discipline to stay on 1:1, which sort of scares me a bit, it doesn't really do much if I can just choose to take it off if I want.

My default margin settings (what it resets to overnight) then went back to 4:1 and I would have to ask for it to be 1:1 intraday, which I did and I tried to make it go back to default again but it didn't work (still resets to 4:1 overnight).

I left on holidays later in the day on Wednesday, I brought my laptop but I didn't bring any extra monitors and wasn't really planning to trade.

NQ and FORD were awesome setups from the day before (NQ with afterhours news going from 3ish to 5ish, FORD with a decent run and closing near the highs and gapping up a bit). I decided to just trade the first hour or so, and I'm glad I did.

FORD chart:

Then some more "holiday trading" on Friday, was going to just watch the first 30 mins - 1 hour, I traded for the first 30 minutes on STXS, got hardly any size and made 1k, went back to sleep for like 2 hours (my time is Mountain Time, market opens at 7:30), woke up again and was in and out of EOX for a big profit mostly just because of the size. Once again I wasn't really very disciplined, I was in 15-20k shares and I asked Suretrader to remove my 20k share max, and I ended up going to like 24k or so initially and then more when I was adding to a winner at 2.90.

EOX chart:

One last day of the month was Monday, August 31st, I knew I was 1-2k away from a 200k month and my goal was to make at least 1-2k I guess. Ended up finishing with my 3rd best day ever but I traded stupidly big and somewhat reckless on VTL so I'm not really very proud of it, also why I didn't want to post the chart.

This is the link to my "Profit.ly" chart with everything from March 2015-August 2015 uploaded:

http://profit.ly/user/JGram/chart

I had uploaded my trades from March to May on "Profit.ly", I didn't do them for June and July, maybe because I was still off my my "all time highs" on June 12, and didn't really feel like it I guess. I decided to upload again and I will continue to upload at the end of end month. Once again, hopefully me posting this doesn't come across as bragging, I don't have anything to prove to anyone, this is mostly just to see the overall chart and progress and be able to track myself better.

Keep in mind, "Profit.ly" works the same way as I did on my blog, meaning that it just totals the average of all the entries and the average of all the exits until you have no position, that all is considered "one trade". As a result, some of the sizes may look really huge but there may be lots of "ins and outs", and the average's/sizes may also seem "off" if there's a lot of exits for breakevenish and rebuying/reshorting around the same prices.

Basically, I lost some money overall for 6 months, August 2014-End of Feb 2015 (mostly the first 1-2 months) (not on the chart), then had two great months (March and April), then 3 months of "consolidation" (May, June and July), and then just straight up "parabolic" in three weeks, just insane. I want to make sure that I don't have a "huge washout" with a big loss at the end of this, it can happen SO EASILY trading this kind of size (like I did today on TRVN, Tuesday, September 1st).

I had implemented 1:1 margin and 20k shares max size, but the fact that I removed my 1:1 limit and my 20k share limit at times means that it's not really effective in terms of preventing a big loss if I'm not disciplined enough to just leave it even if I get "stuck" on something. My plan is to wire back to a 40-60k account 4:1 leverage and keep it like that (wiring out profits as I go). My friend Alex (https://twitter.com/AT09_Trader), is doing a very good job of this, keeping his account around 40k on 6:1 margin and paying himself profits pretty much daily with wiring out. I'm also looking into opening a Centerpoint account (only ETC clearing is available for me until/unless I move out of Canada, but I can still locate shares through Quantex) to be able to locate borrows for things like BLFS/AXPW today, there's usually a few "golden plays" each month that I miss out on because of having no borrows, but still need to make sure to stay safe and be smart about it and not just saying, "oh I can just swing it" and being super stubborn on something and taking a really large loss.

Anyways, that's my SUPER LONG monthly recap for August 2015. Three weeks changed my life forever, I'm extremely grateful. Alex and I just set ourselves up for life (not totally but it's sure a great start at 20-21 years old), all from three crazy weeks. Alex has most of it safe in the bank, tons of "padding" now, and I'm still working on getting that, but it will be there soon. Just absolutely crazy, I'm super grateful for meeting Alex and becoming such close friends with him over the last six months and also for Nate and Investors Underground. I don't think me or Alex could have gotten where we are now without each other, we've had many large "speed bumps" along the way, but now we're well past "all time highs" and "killing it" at 20-21 years old, just so unreal, I cannot express how thankful I am for the life that I now have. Also super thankful for how lucky I was on CLTX, this month could have been 10x different if that didn't work out, I don't want to exposed to such "life or death" (not quite, but like a HUGE swing) types of risks, gotta make sure not to put myself in those situations.

I hope you enjoyed my monthly recap for August 2015, and hopefully it wasn't way too much reading, there was a lot that I wanted to explain.